A brief study…

Some keys to understand why the French Facility Management market is a young but booming market with many opportunities.

A brief history

Facility Management was founded in the United States in the 1980s and appeared in France 10 years later. At that time, « Services Généraux » (General Services) was either a full-fledged department of companies or part of the Purchasing Department. Under the influence of the Anglo-Saxon language and culture, the name Facility Management is gradually emerging.

This is probably because year after year, FM encompasses a wider range of heterogeneous activities which were not originally included in « General Services » before. The market, which was primarily technical, dealt mainly with building services (workplaces), but gradually grew to include all activities providing services to building occupants (employees). According to estimates available in France, more than 30 areas of expertise and 150 job specialties are now part of FM.

In the 2000s, the primary objective of French companies delegating the management of services in Facilities Management was first to reduce the costs of the buildings’ maintenance. Reducing energy expenditure was their main and sometimes sole motivation. This is why construction and energy operators were the first players of the FM in France. They remain leaders today.

Snapshot of the French FM market

Unlike in the US, UK and Scandinavia, the French Facility Management market is still underdeveloped. Nonetheless, it is among those which have the greatest potential for progress.

As a result, private FM players in France are sharpening their positions to exist and grow. Procurement strategies or subcontracting alliances are needed to offer a complete and attractive package. They have very different profiles, but they all have the same goal. They want to gain market share in this emerging and high potential economy.

They can count on the public sector in this regard. With the Public Action 2022 program, the French government wants to reinvent the model of public policy, relying in particular on the levers of digital technology and innovation. Launched in October 2017 by Emmanuel Macron, the program has three concrete objectives: to ensure a better public service for users, to improve the conditions for the exercise of the profession of public officials and to reduce public spending. The aim is to decrease maintenance costs of public buildings as much as possible. The State and the Public Communities subcontract more than ever before the activities that they once carried out internally. Facility Management specialists are contributing to the modernization of French public action.

However, there remains some fragility on the civil society side (in the private sector). The field of FM is less organized than the French winemakers sector. There is only one employers’ organization (SYPEMI), one professional federation (ARSEG), no collective bargaining agreement, no research laboratory, and no student or vocational training in this field. Given the size of the market, the weight of the players, the power of the current dynamics, France does not seem structured enough to succeed yet.

Things can change, and they are beginning to change. Interest in this sector is starting to increase. Some players determined to structure the FM have taken great initiatives. The CRDIA project is going in the right direction. Do we not say « where there is a will, there is a way”?

Public and private players are joining their skills and resources. This is actually the first condition for organizing and developing this sector. The desire is to meet the growing demand of companies and offer them a new world of business services with tailor-made solutions which are effective and attractive, yet sufficiently standardized to reduce costs.

Dynamics of a changing market

In France, this economic sector already represents 1.25 million jobs serving some 25 million assets. Real estate and property are already one of the top three budget items for companies along with payroll and IT expenditures.

In this B to B service market, there are heterogeneous FM suppliers working for contractors who outsource all or part of their General Services. Among these are: cleaning services, building maintenance, gardening, energy savings, catering services, etc.

Each of these activities produces less added value than the recurring issues they engender. Does this not present a good reason to subcontract? Indeed yes, and this leads to subcontracting all the activities related to the buildings as well as its’ occupants. This is why global providers are now offering packages called « Total FM« : multi-technical AND multi-services for the French market.

All of this looks enticing on paper but in reality none of the major FM service providers is truly able to provide everything directly.

For example, security often can not be part of it for practical and french regulatory reasons.

Also, these sets of complex deals require partnerships integrating one or more levels of outsourcing. Those who come from the field of institutional catering do not necessarily know how to maintain lawns and those experienced in building construction do not necessarily have skilled housekeepers or receptionists.

Finally, while some large groups outsource all their FM activities, this is far from being the case for the majority of companies. There is room for major evolution. The growing trend of the French Facilities Management market is to delegate these services to specialized providers. The main operators of FM now communicate on global offers by saying “He who can do more, can do less”.

Who are the players in the French FM Market?

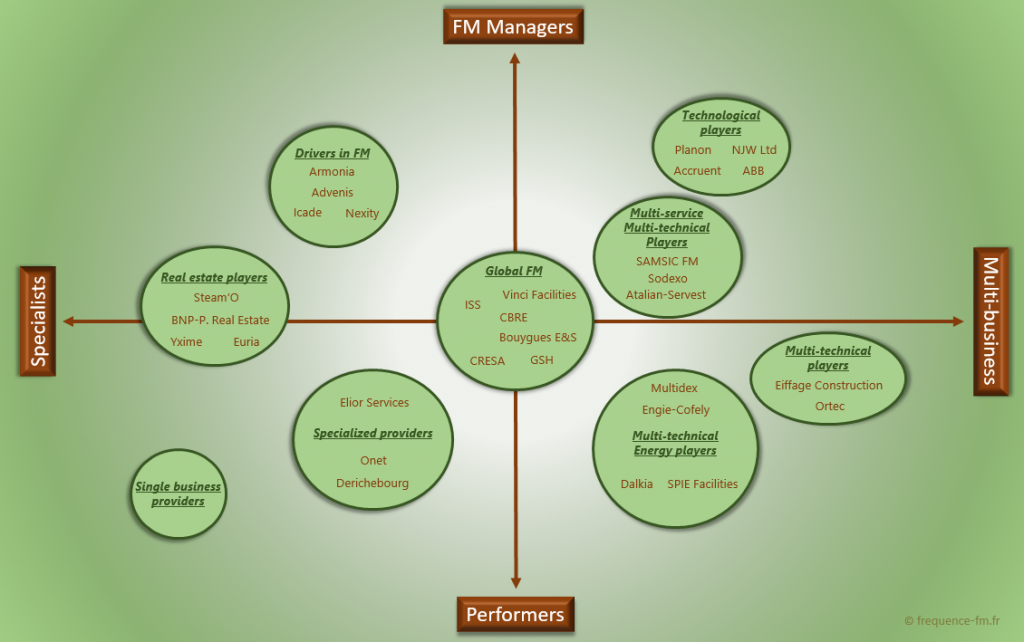

Industry giants in construction (Bouygues E & S, Vinci Facilities, Eiffage Construction …), energy (Dalkia, Engie-Cofely, Spie Facilities, Multidex …), cleaning (Samsic FM, Atalian, Derichebourg, Onet …) or catering (Sodexo, Elior Services, Convergence) share most of the Facilities Management market. All are multi-business operators, some are multi-technical specialists while others are multi-services. But most of them have acquired or made alliances with contractors who possess the technical or serviceable skill they previously lacked. Today, most of these major FM operators are therefore moving towards a global FM service offer strategy.

Among the French players, there are companies that are specialized in FM driving, sometimes from other areas. The « FM Drivers » (Groupe Armonia, Advenis, Nexity, Icade) are companies mostly mandated by a client to manage its Facilities Management by outsourcing to a global service provider or several specialized service providers.

FM in France, as everywhere in the world, also brings together a string of single-business providers. Examples of this are the security, maintenance, computer, plumbing and electrical companies. In this case, the prime contractor has several suppliers for each separate building specialty area.

Also, new entrants from real estate (Steam’O, Yxime, Euria, BNP Paribas Real Estate …) or software (Accruent, Planon, NJW Ltd, ABB …) have come to boost this market. They offer specialized deals in FM centered on their areas of expertise. These range from the overall valuation of the real estate portfolio to the computerized management of site operations.

To complete the picture, we must mention « Global FM » multinationals such as (ISS, CBRE, GSH Group, Mace Group, Cresa LLC, JLL…). These giants have gained a foothold in France with both commercial appetite and an unrivalled global know-how. Techniques and services are reproduced with a powerful efficiency.

Players positioning on the French FM market

The incumbent multi-technical operators have a leg up in the field of energy performance. They have the skills and technologies to streamline the costs of energy consumption. Therefore, they are looking to offer their customers other, more qualitative services in order to boost their profit margins. In addition, they win the bulk of public procurement bids in Public-Private partnerships, which ensures a steady, comfortable income stream.

At the same time, real estate and construction professionals are beginning to benefit from the new provisions offered by public commissions in France. Global public procurement (called REM or CREM) entrusts a single contractor with the Design, Construction, Operation and Maintenance of a building. It’s the opportunity to win a sustainable Facility Management market even before laying the first foundation stone.

On the other hand, software developers know how to offer powerful applications to enable Facility Managers, either internal to the company or outsourced, to monitor and optimize all their services.

These heterogeneous players are therefore positioned in a very competitive market that holds a promise of strong growth. It is estimated to be in the order of 15 to 20% per year. The potential market in France would be around 10 billion € minimum.

Main future trends

The French Facility Management market is characterized by some major current trends.

-

The growth of security needs

Since the 2015terrorist attacks, the French government has strongly strengthened the laws relating to the safety of buildings and events. Companies had to equip themselves with video surveillance, manned guarding and access control services. The demand for equipment, personnel and security services has boosted and remains a strong trend today where the threat persists.

-

The need and the desire for digital innovations

French people have a strong appetite for digital innovations. Computerized management applications are very successful. Facilities Management is no exception. Many companies succumb to the delegation of services in FM after seeing the ergonomics of software simplifying meeting room bookings, maintenance service ordering, or equipment performance measurement and benchmarking.

-

The development of environmental and citizen approaches

Since Paris COP21, the whole world knows France’s leadership against climate change. French companies are now developing a CSR policy to reduce their environmental impact. Each company wants to show its’ civic commitment, sustainable development approaches and its’ waste recycling system. When they call on a Facilities Management provider, they expect it to be equally virtuous in this and to help them develop actions to reduce their environmental impact.

-

FM approaches becomes user centric

The FM market in France is going through a strategic renewal today. This sector is increasingly focused on services to the company and its employees. In France, it is gradually moving from a rather technical BtoB logic to a service logic that is more aimed at the end user. In other words, a « B to B to C ». The relationship becomes tripartite: provider FM-company client-end user. And the service rendered becomes the key to the customer relationship.

In the Facilities Management sector too, the customer is a creator of value. It has both the general use of the building to maintain and particular business needs to meet. Indeed, FM companies are increasingly seeking to position end-use and end-users at the core of their development strategy. Cost reduction and improved energy performance are no longer the alpha and omega of FM contracts. The building becomes support for multiple services.

The Facilities Manager must adapt to reveal the potential « useful effects » of the building. He must be interested in the working environment by proposing solutions to improve working comfort because French companies are increasingly sensitive to the well-being of their employees. And he has to be able to offer business services in terms of reception, conciergery services, grocery, daycare etc. Hospitality management is the latest FM trend in France.

Great opportunities of the French FM Market

As a result, a bonus is given to players who understand and make it clear that FM is much more than General Services. This goes beyond technical maintenance and its operating costs.

FM players who are doing well today have the same two strengths. They know how to build a relational quality with their client based on trust, expertise, prevention and responsiveness. And, they provide them with tailored and innovative advice and services to care for their budget, buildings, users and sustainability.

Behind the growth of the French market for the years to come, the main trend lies in the adoption and development of delegated management of FM services. There will be lucrative opportunities with increasing demand for the outsourcing of FM services whether by industry, large groups, SMEs or public authorities.

Ultimately, France is a major country and a master plan for FM investment opportunities. Public and private players have joined forces to welcome new investors. They are starting to build new bridges to develop the FM business. The sector is getting professionalized quickly with a growing demand. France is becoming a golden opportunity for FM investors with an expected growth of outsourced, standardized and innovative services.

French version of this article

Laisser un commentaire